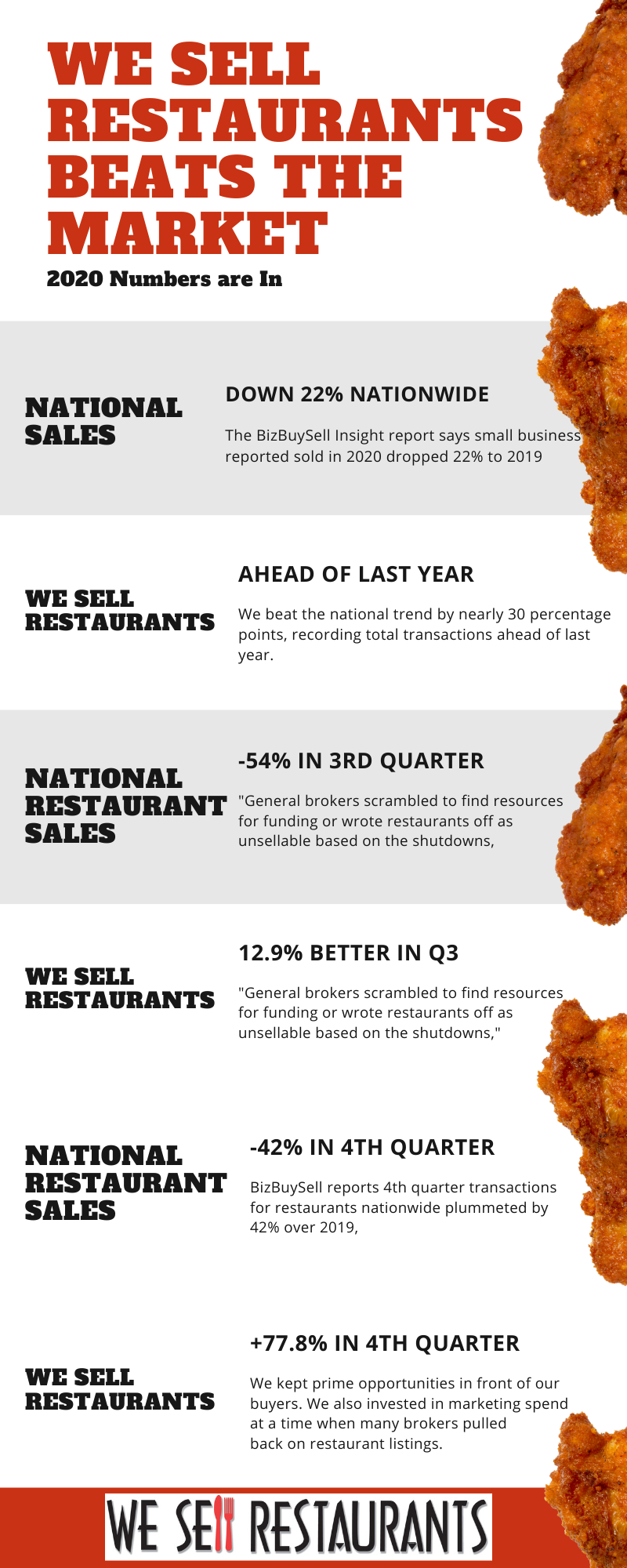

The BizBuySell Insight report is available and based on their data, the number of small businesses reported sold in 2020 dropped 22% compared to 2019. In their words, “this was the largest year-over-year drop since 2009 at the start of the Great Recession when transactions dropped 28%.

We Sell Restaurants, however, bucked that trend by nearly 30 percentage points, recording total transactions ahead of last year. The national report says that 7,612 businesses were sold in 2020, compared to 9,746 in 2019. We Sell Restaurants beat the prior year in units, dollar count per restaurant sold and transaction size.

BizBuySell's Insight Report, tracks and analyzes U.S. business-for-sale transactions and sentiment of business owners, buyers and brokers.

The national report cited the 2020 business-for-sale market as strong heading into March when transactions reported by most business brokers dropped 43% overall with restaurant transaction declining 54% when measured nationwide. We Sell Restaurants was 12.9 percentage points better than the national average in quarter two.

Fourth quarter results when compared to the national data from the BizBuySell Insight Report were stunning. Restaurant transactions plummeted in fourth quarter for most brokers while We Sell Restaurants was setting records with 77.8% more restaurants sold.

What was the difference? Robin Gagnon of We Sell Restaurants says, “Our specialization and focus on the restaurant industry was the difference in transactions moving forward last year. While general brokers scrambled to find resources for funding or wrote restaurants off as unsellable based on the shutdowns, we knew the business.” She went on to say, “It was wrong to paint the entire industry with the same brush. While some stores suffered, it was not across the entire business model. Certain categories of restaurants, particularly fast casual and pizza continue to do well. Restaurant owners are entrepreneurs. Many adapted, pivoted their business model and for some, the results were strong.”

How did We Sell Restaurants outperform so significantly in fourth quarter against other brokers? Gagnon says, “We kept prime opportunities in front of our buyers. We also invested in marketing spend at a time when many brokers pulled back on restaurant listings. The results show in the fourth quarter performance where the industry was down 42% while we were up 77.8%.”

The table below illustrates the trend reported by the BizBuySell Insight Report versus We Sell Restaurants for the same time period. The BizBuySell report did not include quarterly data for Q1 and Q4 specific to restaurants.

|

|

Q2 |

Q4 |

|

We Sell Restaurants Sales Trend |

-42.9% |

77.8% |

|

National Restaurant Sale Trend |

-54% |

-42% |

|

Difference |

12.9% |

119.8% |

What is the outlook for restaurant sales in 2020? In our opinion, several groups of buyers are emerging from the pandemic.

Layoffs from the Industry. There are many downsized individuals from closed restaurants with strong experience. Sidelined during the crisis and hanging back due to enhanced unemployment benefits, we predict they will come back into the market as buyers to purchase themselves a job.

Opportunistic Buyers Seeking Turnarounds. In every downturn, someone is looking to pick up bargains and these buyers have been in the market for several months. BizBuySell surveyed buyers and of those, twenty-seven percent (27%) are specifically looking to buy a depressed business. Eighty-three percent (83%) would consider a business that has remained open but negatively impacted by the pandemic, while 62% would consider a closed business.

Relocating Families. With work at home here to stay, we are seeing tremendous movement across our industry from locked down states to more open opportunities. Many are realizing they can live in lower tax environments and more business friendly states and they now have the flexibility to move with spouses working from home.

Strong buyers seeking cash flow. These buyers never went away. They drove asking prices up in 2020 and will be back in 2021 for any business with demonstrated strong cash flow available for lending especially with the SBA free six month lending program in place until September 30 of this year.

Layoffs outside the industry. Those outside the industry will be seeking jobs as corporations slow hiring. According to BizBuySell’s survey, 21% of buyers identify as newly unemployed with an additional 36% unhappy with their job. After the 2008 downturn, there was a significant resurgence of new businesses launched and entrepreneurs created. We see that trend returning.

Expansion or Consolidation Buyers. Several deals we handed in 2020 were buyers already operating a concept and seeking to expand their footprint. We see this strategy continuing as these operators have cash and are positioned for growth.

Overall, restaurants that survived the pandemic are positioned better than ever before. They have already established they are here to stay and buyers are obsessed with anything showing year over year increases despite the pandemic.

Restaurants took a hit but the P&L data we are seeing reflect strong profitability based on cost controls. Some restaurants successfully negotiated rental concessions. All have figured out labor and food costs with laser focus to net the highest return. While competitors folded, they picked up market share they will not let slip as they adopted technology to remarket via apps, text messaging or digital marketing. Any operator reluctant to explore delivery is now on board with every app in the marketplace.

There is still opportunity on the horizon for these restaurants as well. Most are not experiencing any catering as all the focus shifted to take-out and delivery. Catering will return when gatherings occur again. This revenue will then be incremental to their existing business. When dining room capacity returns, not everyone will be willing to go out but those who do, have pent up demand. That is incremental to sales today.

The restaurant industry and restaurant sales are poised for success in 2021 just as We Sell Restaurants predicted in 2020. Based on our results, you can rely on our advice.

The full BizBuySell Insight report is available at this link.

Robin Gagnon, Certified Restaurant Broker®, MBA, CBI, CFE is the co-founder of We Sell Restaurants and industry expert in restaurant sales and valuation. Named by Nation’s Restaurant News as one of the “Most Influential Suppliers and Vendors” to the restaurant industry, her articles and expertise appear nationwide in QSR Magazine, Franchising World, Forbes, Yahoo Finance, and BizBuySell. She is the co-author of Appetite for Acquisition, an award-winning book on buying restaurants.

Robin Gagnon, Certified Restaurant Broker®, MBA, CBI, CFE is the co-founder of We Sell Restaurants and industry expert in restaurant sales and valuation. Named by Nation’s Restaurant News as one of the “Most Influential Suppliers and Vendors” to the restaurant industry, her articles and expertise appear nationwide in QSR Magazine, Franchising World, Forbes, Yahoo Finance, and BizBuySell. She is the co-author of Appetite for Acquisition, an award-winning book on buying restaurants.

404-800-6700

404-800-6700